MultiFunding Releases Orange County’s Most Committed Small Business Lenders

![]()

Media Contact:

Jennifer Sherlock

jsherlock@jennacommunications.com

FOR IMMEDIATE RELEASE

MultiFunding Releases Orange County’s Most Committed Small Business Lenders

PHILADELPHIA, Nov. 3, 2011 – In today’s tough economic environment, there are banks making loans to small businesses. The banks that are actively committed to small business lending deserve all of our recognition and support, as they are focused on our community, helping unemployment, and regional growth.

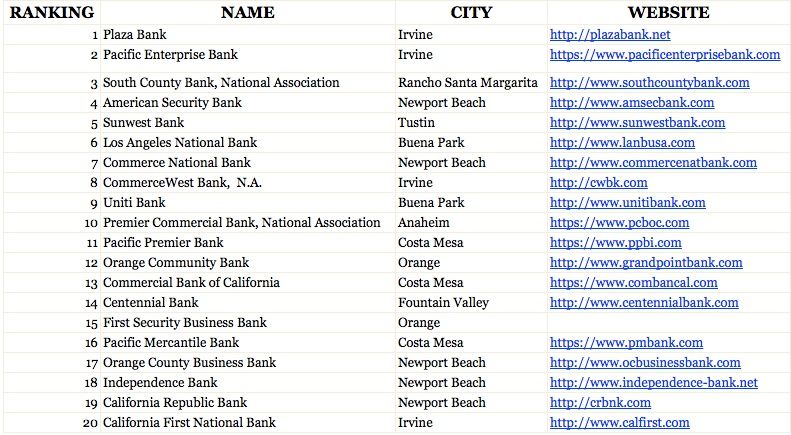

MultiFunding has compiled its first annual list of Orange County’s Most Committed Small Business Lenders. The 20 lenders included in the ranking are headquartered in Orange County. They are all regulated by the FDIC and have a minimum of $100 million of deposits as of June 30, 2011. In order to rank them, each bank’s small business loans are divided by their deposits, as reported in their FDIC call reports. Small business loans are defined as loans with a balance of $1 million or less.

How can we measure a bank’s commitment to small business? At MultiFunding, we believe that the data that the banks report to the FDIC on a quarterly basis about their outstanding loans of $1 million or less is an excellent barometer of main street lending. With this statistic, if there is a loan outstanding with a balance of $1 million or less, it counts. The aggregate number is affected by a number of factors including loans that go bad, loans that are paid now, loans that the bank insists leave, attrition, and new loans.

“The range of commitment to small business lending amongst the banks in the survey is dramatic,” said founder and CEO of MultiFunding, Ami Kassar. “Plaza Bank in Irvine, the top ranked bank in our list, leverages 45.55% of their deposits to make small business loans. In contrast, California First National Bank of Irvine leverages none of their deposits to make small business loans.”

###

About MultiFunding

Based in the greater Philadelphia area, MultiFunding works with small business owners in more than 27 states to understand small business lending options, and to ultimately evaluate and secure the best loan alternatives for their businesses. For further information, please visit www.multifunding.com or view the small business blog at sligshotcafe.net.