MultiFunding Releases Lender’s Responsibility Index

Jennifer Sherlock

jsherlock@jennacommunications.com

609.369.3482

FOR IMMEDIATE RELEASE

MultiFunding Releases Its Main Street Lender’s Responsibility Index

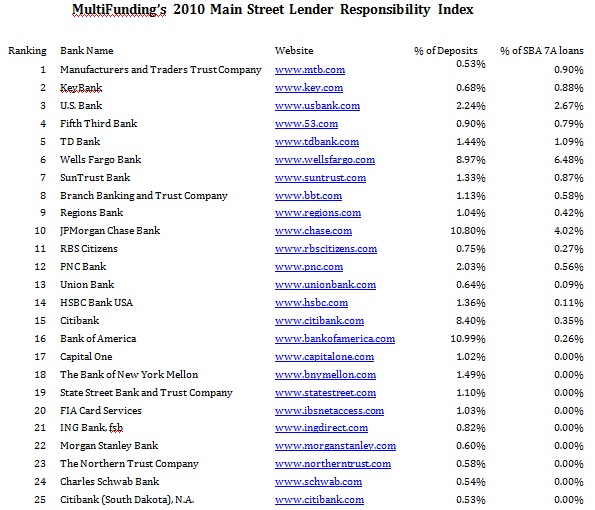

Nation’s Largest Banks are Only Making a Small Fraction of Small Business Administration Loans

Philadelphia, August 10, 2011 – It is popularly known that the Small Business Administration program is one tool to help small business owners grow their companies and add jobs. What is less understood is that the nation’s largest banks are not doing their fair share of SBA lending – stifling innovation and job growth at a time that our country desperately needs all of the financial stimulus it can get.

In an index being released today by greater Philadelphia-based MultiFunding LLC, a small business loan advisor with clients in more than 27 states, it shows that in 2010, while the top banks controlled 60.94 percent of all deposits in the country, they only made 20.36 percent of all SBA 7A loans.

The index reveals that there has been plenty of demand for SBA loans during the recession, with the majority of the demand being met by smaller regional and community banks. While the nation’s banks and lenders approved over $17.7 billion of SBA 7A loans in 2010, only $3.6 billion of these loans were approved by the nation’s 25 largest banks (ranked by deposits).

“The hard facts demonstrate that small business owners are more likely to get the loans they so desperately need at smaller banks,” said Ami Kassar, chief executive officer of MultiFunding. “However, many start the process of looking for their loans at the larger banks, which often creates frustration and confusion.”

“The SBA program is designed to make it less risky and more lucrative for banks to lend to small businesses,” continued Kassar. “If the big banks aren’t leveraging the SBA program, then how are they supporting small businesses?”

MultiFunding’s 2010 Main Street Lenders Responsibility Lender Index ranks the top 25 banks in the country for their commitment to small business lending. Manufacturers and Traders Trust Company is rated number one on the list. They controlled 0.53 percent of all deposits in 2010 but made 0.9 percent of all SBA 7A loans.

In contrast, Citibank and Bank of America, two of the nation’s largest banks had some of the lowest scores on the Index amongst the top 25 banks in the country that participate in the SBA 7A program. These two institutions control 19.4 percent of all deposits and only approved 0.61 percent of all SBA 7A loans in 2010. Despite ranking at the bottom of the Index, these two institutions ranked in the top two spots on the Troubled Asset Relief Program list taking over $812 billion in federal bailout money.

###

About MultiFunding

Based in the greater Philadelphia area, MultiFunding works with small business owners in more than 27 states to understand small business lending options, and to ultimately evaluate and secure the best loan alternatives for their businesses. For further information, please visit www.multifunding.com or view the small business blog at sligshotcafe.net.